Name your price? Not exactly.

FULL MARKET VALUE IS NOT SET BY THE SELLER BUT MARKET DRIVEN.

Time is money when you’re selling. Days-on-Market are determined by Full Market Value.

Speed read:

- Selling real estate involves the three P’s: Property, Price, and Promotion. (see this post)

- The three P’s work together to reach the ultimate goal: sold and closed.

- Real estate markets are dynamic and change over time. No one seller controls the market.

- As seller you have control over two of the P’s: Property and Price. (as your broker I control P #3).

- Sellers set the “price”; negotiations (the market) sets the Full Market Value.

- Time is money when you’re selling; Days-on-Market are determined by Full Market Value.

- Positioning the property at the outset within a well reasoned range of Full Market Value will maximize return of your equity dollars.

Selling real estate is a multifaceted process involving the three P’s: P # 1 is the property, P # 2 is the price, and P #3 is the promotion or marketing. As seller you control P #1 and P #2 and as your broker I control P #3. These three P’s must ben in sync to achieve a successful sale and closing.

There’s never just one single “value” for a property.

There are several definitions of “value” when it comes to real property, each having to do with context. There’s assessed value, used by the property appraiser for establishing real estate taxes; there’s “fair market” value, as measured by appraisers primarily when there’s a mortgage loan being obtained, there’s insurable value, used for insurance purposes (land value gets deducted since it isn’t an insurable asset). Each of these value determinations can differ widely from each other because they each have their own special purpose.

When you want to sell, there’s only one “value” that truly matters: Full Market Value.

When I initially meet with a seller to discuss positioning the property in the market I give them a range of numbers based upon an honest, unbiased professional opinion of Full Market Value. I will present them with a high-point value, a mid-point value, and a low-point value. As an example: high-point = $1,000,000; mid-point = $975,000; low-point = $950,000. These numbers reflect my professional opinion from my many years in the appraisal industry.

In most cases these numbers are reflective of the immediate surrounding neighborhood and suffice. In the case of higher-end properties however, the “market” may need to be expanded well beyond what might be the recognized neighborhood boundaries. More to that point, if the seller’s property is in a community of multi-million dollar homes it’s advisable to consider other neighborhoods that feature multi-million dollar homes as buyers of homes of distinction – for lack of a better characterization – often will consider several high dollar communities within a regional market and not stay confined to one neighborhood or development.

If the property has no apparent adverse features that will generate market resistance (poor physical condition or “unique” decor are the most common) I will recommend that the property initially be positioned at the high-point value, however the seller’s particular circumstances is the deciding factor as to which price point works best for them (it’s not always the obvious high-point).

What IS Full Market Value?

Succinctly put, Full Market Value is the price which you, as seller, and a ready, willing, and able buyer agree upon through negotiation and formalizing the understanding into a legally binding purchase and sale agreement. There is no crystal ball that you can peer into and see that singular number representing the full market value of any piece of real property, but rather it’s a mirage until the property has been exposed to the market and you have received one or more viable purchase offers. EACH and EVERY interested buyer will have their own impression of the property’s Full Market Value.

For serious sellers time is always of the essence.

This is really happened to these sellers:

In this instance, their property was put on the market by another agent initially at $495,000 After several weeks going unsold, it was reduced to $475,000. Several weeks later, still unsold, it was again reduced to $450,000. So now after being on the market for approximately 9 months and still not sold, the listing agreement with that agent expired and the property came off the market.

The seller obviously wanted to sell so they contacted me for a consolation. After review of the property and the market I advised them that the market range for their property had a high-point of $395,000, a mid-point of $375,000, and low-point of $350,000. At their direction, I placed the property back on the market at the high-point of $395,000 ($100,000 less than originally listed). After 30 days it was reduced to $375,000, and after another 30 days the price was again adjusted to $369,000. It sold the week after for $359,000.

Here’s another real world example:

This seller contacted me by email and requested a consultation. In their email they told me they wanted me to list the property at $1,495,000. When I met with them in person and had an opportunity to review the property, I advised them that I wouldn’t bring the property to market at $1,495,000 as the Full Market Value range was a high-point $1,250,000, a mid-point of $1,225,000, and low-point of $1,195,000. Given their desired list price of $1,495,000 they selected another agent and listed the property at that level. Long story short, the property stayed on the market going through a series of price reductions until if finally hit $1,200,000. It sold shortly afterwards for $1,100.00 – A FULL TWO YEARS AFTER OUR MEETING.

Not to demean other Realtors, but sometimes an agent’s desire to have a listing conflicts with their obligation to give unbiased counsel to the seller. Bringing an overpriced property to market benefits no one but instead ends up costing everyone – the seller, the agent, and the brokerage – time and money.

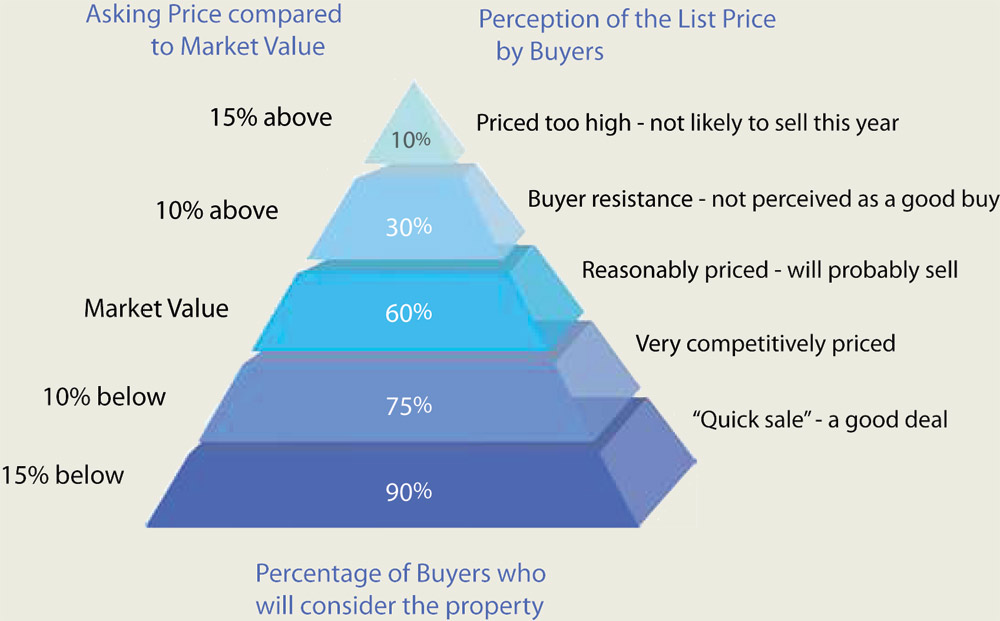

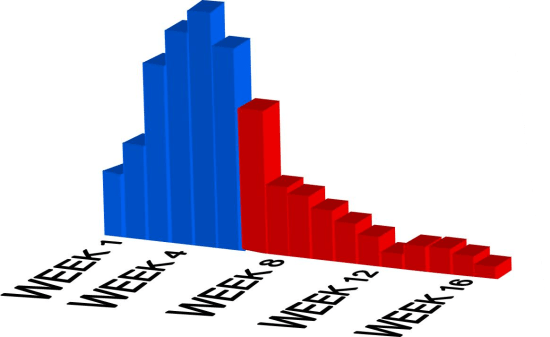

Setting the asking at Market Value at the outset is critical if you want to save time and money. Here’s a graphic that depicts historical market reaction to pricing:

This graphic shows typical market interest level for a property new on the market and the risk of over positioning the property:

Why does this matter?

When a property doesn’t sell unhappy sellers will insist that the reason their property didn’t sell had nothing to do with their asking price but instead say that their broker/agent didn’t do enough promoting the property. I assure you with 100% confidence that there’s no amount of money that can be spent promoting an over priced “product” that will result in a sale. Even if a buyer is willing to pay the “higher than market” price, unless they’re paying cash there’s safeguards in place to prevent the sale from going forward – in most cases that’s the appraisal for the mortgage financing.

If you’re serious about selling, positioning your property within a well reasoned and supported range of Full Market Value will yield the best results. Remember that there are ongoing costs to owning real estate and the faster you can get into contract and to the closing table the sooner you can terminate those ongoing ownership costs. When it comes to selling your property, acting rationally and not emotionally will maximize recovery of your equity dollars and will always yield the best results.

READY TO SELL?

If you enjoyed this article leave a comment below. If you’re ready to sell send me an email and I’ll get back with you to for a free selling consultation.

Jerry Clinebell, Expert Listing Agent

GET YOUR FREE PROPERTY VALUE ESTIMATE

Enter your address in the box and instantly get a free value estimate.